Dear Js,

Buying a house has been a mystery to me. My parents didn’t let us in on the gritty details, and I hadn’t bought one before. All I knew was it was going to cost a lot of money in this town. And with anything that costs a lot of money, you can’t afford to make any mistakes, you don’t want to pay too much, and you want to end up with a house you feel good about living in for a long time.

So this letter is a summary of our home buying process, in case you’re curious or you plan to buy your own home one day. Who knows, maybe something in here might come in handy someday.

For the first few months, all we did was collect data and visit homes. I was waiting for August to buy. That’s when I would get my biggest spike in income. So meanwhile, we did our best to educate ourselves. I set up my Secret Spyno to trawl a site called Redfin. Redfin is the closest we could get to an MLS, without being a realtor. What I found later was that with Redfin and Spyno, I found new listings before our agent got around to telling us about them. Most of the time, it was us telling her “Hey we found these new houses and we’re going to their open houses this weekend.”

At first we had our spotlight on Cupertino, for the schools. But we soon found that Cupertino was not for us. For one, in 2015, you don’t get much house (if at all) between 1-2 million dollars. We visited houses that sold for $1.3 million that were right in front of train tracks, crumbling, and stank like pee and shit because the owners housed enough animals to be a zoo. The other thing we became iffy about were the schools. Or more specifically, the parents who kill each other (and their kids) to get into the schools there. It seems to be a place that attracts hypercompetitive parents who only care about college prep and things that can be tracked by a report card. Our dentist told us a story about his brother’s son trying to ask permission for a play date from his friend’s mom. The mom set up an interview, and she asked questions like “What are your son’s hobbies?” “What STEM programs are your son enrolled in?” And after the interview she announced, “I’m sorry, thank you for your invitation but I don’t think we’re a good fit for a play date.” Which baffles me because clearly the kids are friends in school.

We had to ask ourselves, is this place really worth suffering in a tiny, shitty, expensive home, in the middle of a concrete wasteland, just to get you hyper-competitive school community with hyper-competitive overbearing parents? To us, the answer was no.

So we shifted our search to other areas. If you open up the traffic heat maps for the Bay Area, you can clearly see where the epicenter of activity is. They cause jams going into the areas in the morning, and they cause jams leaving the areas in the late afternoon. E.g., Mountain View & Palo Alto. Facebook, Google, Apple, Stanford, etc. If you push a pin into the epicenter, you’ll see traffic flowing to/from the region and causing congestion any time freeways merge. E.g., 85 and 280. 237 and 101. 17 and 85. Part of it is due to shitty freeways designed for a time before North California became Silicon Valley, and part of it because of shitty drivers with one eyeball on their smartphones. Another big part of the congestion is a Placement problem — people aren’t placed close to where they commute to. There aren’t enough residential units within the bay, so most people commute for an hour or more. Longer commutes means traffic resources are locked for longer periods of time over longer distances, creating more congestion.

So if Cupertino was out, that narrowed things down to one place for us: the Los Gatos and Campbell Union High School districts. How did we come to that conclusion? Simple. Draw an increasing radius from Mountain View, and stop at the nearest location you like, that you can afford, and has schools you like. We didn’t like the north/east because that was the congested corridor for everyone who commuted from the East Bay. We didn’t like San Jose near 101 also because that’s the gateway for people commuting from San Jose and as far south as Gilroy or further. The only place left was near 85 and the Santa Cruz mountains. The benefit of the mountains is it naturally deters commuters. People tend to think twice about commuting past those mountains, and you can’t build many homes there for miles. Plus, the schools are great and you get views of the mountains and tree-lined streets are common. So if you imagine how things will be like in 20 years, I think all other regions will get much worse before the cities near 85/Santa Cruz mountains. But note that I’m not talking about living in the mountains. That’s stupid if you have kids. I mean closer to the freeways and the schools.

We’re quickly running out of space in the Bay. And with the tsunami of new employees feeding into Google and Apple campuses and nearby tech companies, we thought it’d be a good time to plant our flag, claim our land and hunker down before it hits. I estimated that we only had 3-5 years before the new hires/immigrants make enough money to start competing with existing Bay Area residents for homes. So I plan to be always 3-5 years ahead of the wave to get the best bang for buck and good ROI when we sell later. Soon, they’ll be shopping for starter homes/townhomes, and we’ll be in a single-family home. In 3-15 years, they’ll move into single-family homes for schools/family, and we’ll upgrade to something else after their demand makes our home value skyrocket.

Anyway, let’s now get to what I promised I’ll show you today — how we bought our house. In the Bay Area market, you always want to get pre-approved for a loan first. Find an agent you like and get pre-approved. That will tell you how much house you can afford so you can narrow your search and not waste your time. We found our agent after I searched for “What’s it like to live in Los Gatos” and found her blog. I was impressed with her wealth of knowledge and solid data and facts over decades living and selling/buying in the area. And I can say now that when you’re buying/selling in the Bay, two things are important in an agent: 1) experience and data of the area/market — for accurate estimates of market prices and competition — this is invaluable for making offers, 2) connections — for as much knowledge as you can get about how “the enemy” (other agents) works, and for smooth/fast and pleasant transactions.

Our agent M learned from her mom who was also a realtor in the area, has been in business since the 90s, and once wanted to be a priest. How cool is that?

I’m going to skip our failures and jump straight to the house we won. These will mostly be snippets from our emails.

————–

Aug 4 – Mama: “This week looks promising…”

Me: Shopping time!

————–

Mama: Looking more carefully while trying to put j to nap, I think I like Baron better than Dickens and Elester. It is brighter than Dickens and has a bigger lot than Elester. It also goes to Alta Vista and the street looks great.

No harm in seeing them all though. It gives perspective and good comparisons for what’s on sale this week.

I would remodel/change a few things but it is also perfectly fine the way it is for a while ??.

Do you have a preference between elester and baron?

————–

Me: I prefer Baron too. Bigger rooms, bigger bathrooms and bigger lot. But not sure how to expand. Might have to see it in person to be sure.

(Our agent took us early to the broker-only showing. We saw the house in person and figured out the perfect way to expand the house, adding pure value without any cons.)

————–

Going through the Baron disclosures and inspections

Hi A & M,

V [the listing agent, who happened to work in the same office as our agent M] used good inspectors – that’s a help! (Also she works with D [our lender], so that helps your position in that she trusts D.)

The roof is good – no real issues at all.

The pest inspection report is pretty clean with just about $2000 worth of Section 1 work. It needs fumigation.

The home inspection report says that they did not test the water pressure regulator. I’m not sure why he didn’t do that, my regular inspector does. They look for a range for the PSI (pounds per square inch, I belive). If it’s too high, the faucets and water appliances can wear out too fast. If it’s too low, you won’t have enough water pressure in the shower. Older water pressure regulators may need to be replaced and that can run a couple of hundred dollars. Once in a blue moon (or less often), an old one gets “frozen” on and then replacing it gets very involved and expensive (thousand bucks? more?). I have only had that happen to one client ever – but it’s a good reason to know that that valve is working and does not need replacing.

The water heater is 20-24 years old. They usually only last 10-12! This might be a really good reason to get a home warranty….

Most everything else was self explanatory.

Often I find that homes need about 1% of the purchase price in repairs. That would be appx $12,000 in this case, but the items listed do not seem to be even half that much. That is a really good sign!

M

————–

Hi M,

We are thinking of making an offer on the Baron house. We will visit the open house tomorrow one more time to confirm.

While we’re there, we’ll swing by the Sharon house too.

Hope you’re having a good weekend!

Me

————–

Baron offer?

Hi A & M,

How’d the retour of Baron and the visit to Sharon go? Anything you’d like to chat with me about on either one?

Offers on Baron are due Tuesday at 3pm, so if you want to write it up, we need to get going on that (as you know, it takes a few hours).

M

————–

Hi M,

We just got back after visiting Baron. Thanks for checking in. V was very nice. I met her husband too. We ended up chatting for a while.

Yes, we would like to make an offer for Baron. We’re going to start working on the cover letter. Do you need anything else from us?

Me

————–

Hi A,

Thanks for the update. That is great!

Right now my computer is getting a new hard drive (it is great being married to an engineer!) so I am off it for right now. Either tonight or tomorrow morning I will let you know for sure what else I need from you. I think your proof of funds is pretty current but if you have your Aug 1 statements which show your names that would be ideal.

If you can show that you have money beyond 20% in case of an appraisal shortfall, to be used only if needed, that would also help. I remember you wanted to write the next offer with no contingencies at all. In that case it would be good to show that you could absorb an appraisal deficit if it happens.

The last thing I need to know of course is the purchase price you wish to offer. I am sure that that will depend on how many offers we think are coming in. I will talk with the listing agent tomorrow and see if I can get a handle on that.

Thanks again and have a good evening!

M

————–

Could you please also help us estimate what the house would appraise for?

Because if the bank appraises the house up to $1.3 million, I could get a loan for up to $1.3 million.

But the house will appraise for less, so I would like to estimate what that value is. That way I can calculate how much I can safely offer (without contingencies) with the cash I have.

Me

————–

My pleasure. I will do that tomorrow morning.

M

————–

Thanks! I will also get you my Aug 1 statements for proof of funds tomorrow.

Me

————–

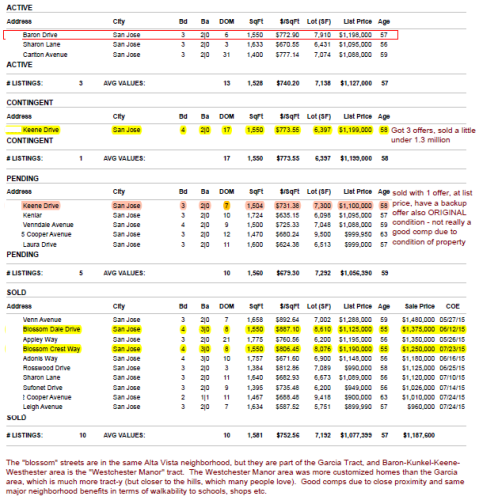

Baron comps and likely appraisal

Hi A & M,

Attached are the comps for the home on Baron.

There are 2 recent closed sales of homes similar in size and in the same neighobrhood – one at 1.25 mil and one at 1.375 mil. One of the pendings on Keene is a little under 1.3 mil sale price. The other pending sale on Keene was “all original” (awful looking) and it sold with one offer at list price of 1.1 million and it has a backup offer. (Someone would need to put a lot of money into that home.) The agent on Keene said that she met with V and her sellers and they are expecting the house on Baron to sell for 1.3 or so – or a little more. That is super helpful info.

If an appraiser uses the 2 “blossom” street sales and the one Keene pending, the home should appraise for 1.305 if the 3 of them are just averaged.

The lowest number that Baron could reasonably appraise for would be $1,275,000 or $1,280,000 but I think it is likely to appraise for more than that, probably around 1.3 million. It just depends on the appraiser. D’s appraisers DO factor in pending sales so that is actually an enormous help in this market. She told me recently that she hasn’t had problems with appraisals at all.

To get the house, you’ll need to stretch a little beyond where everyone else is going to go. I think it’s likely that they will get a few offers right at 1.3 million since the value is pretty clearly there. I do not think it should sell as high as 1.35, though – that would be too much for Westchester Manor

M

————–

Thanks M!

Do you think the house will appraise as high as XXXX Blossom and XXXX Blossom Crest? Those are 4 bedroom houses and this Baron house has 3 bedrooms.

Me

————-

The 2 Blossom homes are vastly different from each other. Blossom Crest is original and pretty yucky – it is also a loud street, being close to Blossom Hill Road. That is right on the hill and may have views but almost always there are big drainage / foundation issues over there. That was aa sale at 1.250 and the home needs everything. Baron will definitely sell for more, no matter how many bedrooms – it’s the same SF but Baron is livable and this one, not so much.

The Baron house enjoys a nice level lot with a great backyard. Blossom Dale is on quite a slope and the whole back yard, which is small, is deck. (That area is notorious for water and foundation issues too.) The interior is much nicer, though. It sold at 1.375. I think most buyers value the interior much more than the exterior, so would probably choose Blossom Dale over Baron had they been neck and neck. For that reason, I do not think Baron will sell for as much as Blossom Dale did. Even if they got 10 offers, I don’t see Baron selling for 1.375. That is truly the high end of value for a home of this size.

I’m going to run over to Baron in a little bit and do my Agent Visual Inspection Disclosure. When we get you the disclosures to DocuSign (probably tomorrow morning), that will be in there. V is working on hers too, and whenever I get it from her I’ll email to you and include it as well.

M

————–

I see. Would D’s appraisers consider all those factors? E.g. livability, “yuckiness”, level yard, etc.

Because I agree as a human that all those are pluses for the Baron house. I’m just worried that appraisers follow strict formulas that go by the numbers, and may miss the value in the house that we appreciate as people.

Me

————–

Yes. All appraisers must factor in the condition of the property. They cannot equate remodeled with 60 years old and need of total rehabbing. They “adjust” for everything – condition, size, location, useability, views, plus beds / baths, additions, area libilities (bad noise) anything that would impact market value.

M

————–

M, why didn’t you highlight Appley Way and Adonis Way as good comps?

Is it because they were sold too long ago?

Me

————–

Hi A. Lots of reasons. They’re not in the same neighborhood – they are close by but not in the Alta Vista area. Both of these houses are on the opposite side of Los Gatos-Almaden Road (prices tend to jump about 3% when you cross the road and get closer to the hills, sometimes even 5%).

The area which has the most influence will be those which share the ability to walk to Alta Vista and Union without crossing any big streets, and can also get to Safeway without crossing any big streets. They’ll have the same major boundaries: between LG Almaden and Blossom Hill, between Union and the creek.

Adonisand Appley are also much larger homes on a much smaller lot. Apply’s lot is a measley 6200SF.

The Blossom homes are similar sized houses on similar sized lots (within 1000 sf lot size and within 5% of home size) in the same general neighborhood. So of the closed sales, they are by far the best comps.

An appraiser could certainly choose to use them but would need to adjust (if he or she knows anything at all) for the exact location. The Westchester Manor / Alta Vista area always sells a lot better than the homes over by the cemetery.

Hope that helps 🙂

M

————–

I see, that makes sense. Thank you for explaining. Hmmmmmmmmmmmmmmmmmmmmmmmm

Me

————–

(Me to mama:) Idea

There is one potential source of funding we haven’t explored: taking a loan from your own 401K.

There are no penalties, interest rate is low, and you have up to 15 years to repay (if you are financing a home). Plus, the interest you pay on the loan goes directly to you. Also, no credit checks required because you’re the lender.

The only downsides I see are:

If you miss payments. Then it gets treated as an early withdrawal and taxed.

Your contributions to 401K are suspended until you fully pay off the loan. This is bad for me. But doesn’t matter for you since you’re not making 401K contributions.

Should we consider it, just to push our offer an extra $10K or so?

Me

————–

I am leaning to yes but let me think about it?

Mama

[We later decided that taking a loan from your 401K is usually a bad idea. But the discussion motivated mama to call her bank anyway. Because of that, she found something better instead — she can withdraw $18K with no penalty and no tax repercussions. This is a bonus for rolling her 401K over to IRA, but only valid for a first home purchase.]

————–

Baron offer discussion

Hi M,

Given what we know about the Baron situation, what do you expect the ideal offer for Baron to be?

I’m hoping we could draw from your experience to be our “Oracle” to estimate the sale value & terms.

Then we can see if it makes sense for us and how far we’re willing to push to get there.

Thanks!

Me

————–

That’s a great question and I really wish I knew the answer. The pending sale on Keene which is in better condition is selling just under 1.3 million but the lot is quite a bit smaller – 6397SF vs the 7910 SF on Baron. And Baron doesn’t have the green island that many buyers would not like, and Baron has a more functional back yard. So just head-to-head comparing, I’d put Baron at $1,325,000 for value compared to Keene (that’s the gut feel price only).

If we next consider the other Keene sale which is pending at 1.1 but is hopelessly in need of updating, that’s possibly a 200k job, but could probably be done for 150k. Since it’s a lot of work to rehab a house, the value would be the sale price + rehab price + inconvenience premium since it’s probably a 3-6 month project or more. Even then you’d still have a smaller lot than on Baron. So I’d have to say that head-to-head with the Keene fixer you’re at 1.3 mil easily.

The Blossom comps support something in the 1.3 or a little above range two. (Their average sale price per sf would put Baron at $1,311,000 but that’s not totally fair since one of those homes was a complete fixer – so I’d lean toward higher than the average of those two.)

I’m being repititios but 1.3 is really more than a fair price, it’s probably a hair low, and if there are 4 or 5 offers – which you never know until they actually show up – it’s likely that most will cluster their pricing around that number.

I believe it will sell between $1,325,000 and $1,350,000, maybe not higher than $1,340,000. I cannot see anyone paying more than 1.35 for it.

V called and told me that another agent is going to present in person at 4:30pm, a little after her deadline but the other agent cannot help it and V’s not meeting with her clients until 6:30pm. As of right now she has just 2 confirmed offers, yours being one of them, but I do believe that the number will grow.

What is a big help is that you have met her and she really likes you and your family, and she knows and trusts me to do a good job with no drama. Even so, she’s going to be fair to everyone and that won’t guarantee us a counter offer if she gets a better contract.

I hope this helps! (And I hope you don’t mind my long narrative answers.)

M

————–

M, with your $1.35 “crystal ball” offer estimate, how much of a difference would contingencies make?

I’m comfortable waiving the loan contingency and property condition contingencies.

But the appraisal contingency is a little more tricky because it depends on cash vs appraisal difference. Do you think it will hurt the offer significantly to leave it on?

Me

————–

Most sellers don’t want to sell with a big overbid if there’s an appraisal contingency because it means that if it doesn’t appraise, which they have no control over, you’ll back out. Probably better to offer less and eliminate the contingency, if you are comfortable with it. The home on Montellano that sold did have a loan contingency, but not an appraisal (and not a property) contingency.

We’ll write it up however you wish, of course.

I’m about to call it a night for work – if there’s anything urgent, please text me.

Thanks,

M

————–

Thanks. Feel free to answer this email tomorrow.

With a $1.35 sale price, is that what you consider a “big overbid” scenario?

How much lower than $1.35 could an offer with no appraisal contingency be, to be competitive with a $1.35 offer with appraisal contingency?

Hmmm, they offered 40% cash at the Montellano house, didn’t they? I’m surprised they had a loan contingency with so much cash.

So is it safe to say that appraisal contingency would be the biggest contingency (in the eyes of the seller) for the Baron house?

Me

————–

Hi A & M,

Thanks – still trying to get off the computer….

Given that the home is going to sell for 1.3, that’s 100k over list and that is a big overbid. When a seller sees an appraisal contingency, that just says to them that you cannot really afford the house (unfortunately). I would agree that the appraisal contingency is the #1 issue for sellers. Most will tolerate a loan contingency if short, but prefer none. Most provide presale inspections so don’t think there should be a property condition contingency. So it usually comes down to best price and best terms after that.

I really cannot tell you at what point a seller will take a lower offer with no appraisal contingency versus a higher offer that has one. I believe that most (9 out of 10) will take the sure thing over the higher offer with that contingency added on. They want to know that when it’s sold it will not fall through. Security is really important.

The appraisal issue is the main reason why buyers with 20% down have trouble competing in multiple offers. In most cases they just do not have the resources to make up the appraisal deficit.

If it is a choice between a lower offer with no contingency or a higher one with it, I’d suggest the former – since you asked for my input. We never really know, but this is my best input based on what I’ve seen. I wish we were in a market where writing it with all of your contingencies was likely to work, but when there are multiple offers that often just doesn’t.

M

————–

[Now that we have decided to make an offer, Mama and I discussed what price to offer. After much research and deliberation, we agreed on a competitive price. At that price, we knew bought into the point where our cover letter could swing the deal. So we started working on our letter.]

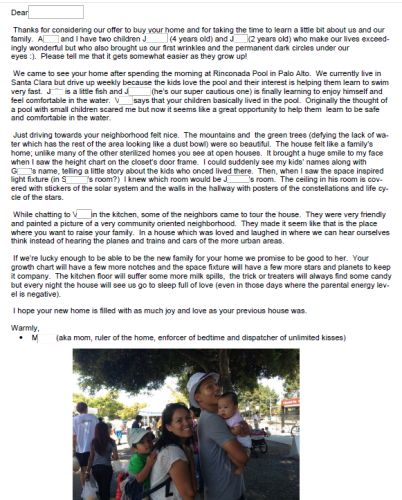

Our Cover letters

Making an offer for a home is a 1-2 punch: offer + cover letter. Offer = logical appeal. Letter = emotional appeal.

I might be sounding like a broken record, but hopefully by now you know that people make decisions by emotion first. People decide with emotions first, then justify their decision with logic. So yes, you need to meet to the bar with a serious offer, so they don’t outright dismiss you. But once you get into the ballpark, what seals the deal long before they glance at your $ offer is emotions.

We decided that the theme for this house was Family. I needed to hit as many emotional triggers as possible. And also highlight as many similarities as possible between our families to motivate Liking by Similarity. Because we all start out as strangers. And in an environment where everyone’s a stranger, little things you have in common make a big difference over your competitors.

So how do you find the emotional triggers? Research of course! After hanging around for 30 minutes at the open house, I stayed behind after to chat with the listing agent for another hour. I squeezed everything I could from her without being too suspicious. Poke, get a conversation going, then shut up and listen. Poke, then shut up and listen. Let her spill the beans. I needed to find out everything I could about the sellers. I needed to gather as much ammunition as I could so I didn’t have to go in blind. You Js were in the car with Mama and Abu. I stayed until there was nothing left to squeeze.

Here’s the list I made before I started writing:

Emotional triggers

Growth chart – sentimental value, refused to paint over it. We’ll pull out the moulding and send it to you.

Light fixture. Love it. Don’t forget it. Where did you get it? Look at our ceiling.

Pool – kids love it, live in it. Swim every day. They were planning to drop by after the open house because they missed the pool.

Neighborhood

Kids growing up, going to school

Goodbye memories

Basketball hoop

Grape bushFlattery/Vanity

Tastefully done, kept things simple and as is. Another house down the street – stupid additions

I am so glad you have good taste. Resisted the temptation to blow up the house. Everything flows

We overheard someone wanting to remove the closets at the end of the hallway to add a room. There are some crazy people here!

Well-maintainedSmooth/fast transaction – I found this after asking the listing agent: “Are there any things in particular the seller is looking for? We like this house and we want to try to give them everything they want.” How to sell: find out what people want and give it to them.

contingencies, speed, cash, loan speedSimilarity

Family

boy, girl

love space/planets

I love water, just learning to swim, we go to rinconada, little newts with floaties

my wife has a fear of swimming, so it could be a great chance to fix her

mutt – chihuahua, terrier, dachshund – she has an existential crisis every time she gets near water but sometimes she jumps in. It would be great to watchHouse going to a nice family, goodbye childhood home

We’e sorry you have to move out

we hope we’ll be the kind of family you’ll want to pass the home to

We’ll take care of it

love, play, etc

We’re not going to tear the place down.

We’re not crazy, but we have a crazy dog

public schools

[And these are the cover letters we wrote and submitted with our offer…]

————–

Baron offer

We would like to make an offer for $1.34 million and no contingencies.

But before we do, could you please go over our reasoning below, and comment if any of our assumptions are wrong? I want to make sure we didn’t miss anything.

Our reasoning:

I’m assuming the house appraises for $1.3 million.

I can get a loan for $1.3 million to cover the appraised value. I’m okay waiving the loan contingency because I have the down payment in cash, I have excellent credit, and D pre-approved me for $1.3 million with only my base salary (which is 70% of my total income)

I need $260K cash for 20% down payment for $1.3 million

I need an additional $40K cash to get to $1.34 million

I need $300K cash total to make an offer for $1.34 million

My proof of funds shows I have $318K, so I have $18K of buffer

To further absorb the risk of waiving the appraisal contingency, we’ve found an extra $28K cash:

M used to work as an engineer so she had her 401K saved up. She gave the bank a call and she will be able to withdraw $18K with no-penalty and no-tax from her IRA, but only for financing a home.

M’s mom has also offered to loan us $50K. We do not plan to take her offer unless we need it. E.g. as insurance for our lack of contingencies or for emergencies.

What do you think of our offer?

Me

————–

[I called M. She said the offer was “very aggressive.” So I asked if we were too aggressive. She said let me check…]

Good morning,

This is the email I was working on when you phoned at 8:15 or so:

~~~~~~~~~

I just saw your recent mail and scrolled back and found this one. My apologies, it was here but I missed it.

Thanks for the thoughtful and detailed explanation of your reasoning. It all makes sense to me.

As you know, we do not control the appraisal process at all, but we do know that D’s company owns the appraisal company and they only hire good, experienced, qualified appraisers (rather than get some bozo from out of the area with no experience – that is often a disaster) and a good appraiser should see the same comps we are seeing and be able to find the value at 1.3 million. D says that she has had no appraisal problems and that’s good.

When I ran the comps, I based them on the MLS square footage of 1550. Yesterday we got an update from V that in the past some appraisers have found the SF to be 1500 (2014) and 1610 (2001) so it’s possible that the value could be swayed depending on the appraiser’s measurements. If it is seen to be 1500 it will be a little lower and if 1600 a little higher.

It is extremely likely that it should appraise to 1.3 million but neither D nor I can promise you since of course we do not control it.

Also, if you do have to cash out of 401k or similar accounts, there could be a tax liability (not sure, maybe an exemption for buying a home? that would be a question for your tax professional such as a CPA).

~~~~~~~~~~~~~~~~~

I just spoke with D and she is going to send over a letter without a price on it (so good no matter what you decide) and she can join V and me at 2:30.

M

————–

Hi M,

Thanks so much for your help and you concern. I spoke with my financial advisor at Fidelity yesterday evening. He told me that from my 401k with Oracle, if I move it to an IRA I can take a max of 10k tax exempt if it is to buy my first home. I also discovered that I had a Roth IRA with them that I had forgotten about. From that, if I move the total amount into the IRA I can withdraw my contribution (not the interest earned) also tax exempt as long as the interest earned stays in the IRA. I’m not concerned about it and he said he can make it happen fast too in case we need to. My mom is calling her financial advisor at her bank today and will make sure to have 10k ready for us since this is the max amount for a tax free gift. If it is more than that she’ll need some time to move some things around to convert them into cash. I’ve never asked my mom for money before so she was super happy to help (nothing like helping your children and grandchildren get their first home!),

I’ll be out of the house this morning until noon. I facilitate a breastfeeding support group in Campbell but I’ll have my laptop and phone so if you need anything from me please just call. After that I’m taking the kids to Happy Hollow in the afternoon but I’ll bring my gear too hehe. Thanks for all your help! We weren’t planning on touching retirement savings but with no tax repercussions and hoping in the area to continue going up in price as it currently does it wouldn’t hurt us in the long run. Anyway, I need to run out.

Thanks again to all of you, M, D and V too! If this goes through I’ll bake something for you all (sugar free for you of course!)

Warmly,

Mama

————–

More info

Just got of the phone with V. As of right now, there are just 2 confirmed offers plus 2 others hovering.

I learned who the other confirmed offer agent is, it’s someone I know well, B Lister. Also I learned that his buyers bid on the nicer Keene house but lost out, so they are super motivated to get this house.

The other agent who’s hovering is a sweet gal and good agent I know (I saw the cards at the house when doing my AVID yesterday and she had 2 cards there), B Kehl (sp?) who lives somewhere close to Baron but I’m not sure where.

If we assume 3 offers, it might be OK to lower your offer price a little. Maybe 1,330? 1,325,000?

B will know that the home they didn’t get is pending for a little under 1.3 million, so I think he’s likely to come in at over 1.3 – maybe 1.310, 1.315 or 1.320 or 1.325. Just guessing.

B does a lot of sales volume but he’s always kind of frantic and late and harried. V knows this about him. I am 99% sure that if your offer came in at the same price as his, they’d take yours, or if his is a little higher, they’d counter you to match his, because V feels like she knows and likes both you and me. Bonnie K. is a rock solid, wonderful agent but V doesn’t really know her, and there’s an easiness about an in-office transaction. Both V and I work with D, but also we both use the same transaction coordinator, Sonia Sisto (in house).

So I think you are looking good.

Lastly, V said she’d circle back to me at noon if anything changes.

What I’d like to do is go ahead and have you pick a price and do the paperwork. If anything big changes, we can redo page 1 of the contract (just that page) to change the price.

Does that sound OK with you?

M

————–

Thanks M! You are so sneaky, we love you!

Let’s lower the price to $1.33. How does that sound everyone? (I’m at work now and Mama’s at home)

Me

————–

Mama: I say ok. Red light reply 😀

[Mama on the way to breastfeeding group]

————–

Sounds good to me!

Thank you!! (Yes, a little recon goes a long way.)

M

————–

Hang on. Did you say that if our price comes in low, V likes us enough to counter us to match the highest offer?

If so, am I being silly for not offering $1.325?

Because then, that should be high enough to show that we’re serious, but if anyone bids higher, we can match them. Will that work, M?

?

Me

————–

No promises. But I think V would encourage her clients to do that – you never know, sometimes our clients do not follow our advice, so if B or K come in higher, they may just take it and you will never get the chance. In other words, I think V is sold on the A + Mama + M + D team, but if B or K’s offer was stronger (all cash is hard to beat, for instance), they may go for the other offer.

One approach I find most helpful is the personal test of being able to live with the offer if you get yours accepted or not. Here’s what I mean:

1 – if your offer is accepted without being countered, will you be upset for fear that you offered too much? (Bad scenario and I hope that wouldn’t happen)

2 – if you miss it and later find out that someone else got it for X amount of dollars more, would you be upset that you hadn’t offered that much because you were really willing to pay it? (If you offer 1.325 and B’s people offer 1.33 and he gets it and you never see a counter offer, would that bother you?)

If you can write an offer and be at peace either way that you did or did not get it – you’re ok if you get it at your price and you are ok if someone pays more – then I think you got it just right.

M

————–

[I called Mama to discuss the offer price and we stayed at $1.33]

Went well

Just leaving my office now. The meeting with her that was official last about 45 minutes and then we were sitting around talking about all kinds of the other things. We will probably not hear anything until 830 or 9 o’clock tonight at the earliest but we should hear something before we all go to sleep. I will keep you posted.

The meeting went extremely well, she was very impressed with our thoroughness and with your letters and with everything in the offer. So I feel good about it.

M

————–

[On the evening of Aug 10, we got a call from M. Her first words were, “We’re on the brink of some good news.” I said, “Brink of some good news… is the news good enough that I can I put you on speaker?” She said yes…]

WOOOOOHOOOOO!

Thank you M!!!

Me

————–

It’s a total celebration over here!

Mama

————–

Still waiting for confirmation – it’s never sure until it’s signed and I don’t have it back yet but do expect it within the hour. Hang on – looks like we are almost there!

🙂 I never celebrate until I have it signed and in hand – hope to have that soon! They were eating dinner an hour ago. Takes a little time to sign, then scan and return… Hang on…. Almost…..

M

————–

SMS from XXX-XXX-XXXX

Just got a text that your offer is signed. She will scan and send shortly. Yay! Should have it soon.

————–

Aug 11 – Baron Drive ****** CONGRATULATIONS! You’re in contract! *************

You should celebrate! This is a great moment! V said that her clients loved your letters, by the way!!

I needed to acknowledge receipt of the ratified offer so have done that and sent it back to V. It’s attached.

Tomorrow I’ll get you a list of what’s next (the big thing will be the 3% deposit, due in 3 business days, wired in). I’ll get you info on that tomorrow.

Congratulations and very well done!!!!!

Hugs!

————–

[Mama and I hugged. She said, “I’m happy I finally got to give our kids something I never had. A house. THE house.”

Me: “THE house?”

Mama: “A house where we don’t have to move. When I was young I moved into what we thought was THE house. Then an apartment. Then the apartment above. Then another apartment. Then another house. Then I went to college.”

We got M a book. “1000 years of solitude” by Gabriel Garcia Marquez. I thought of the book because M loves writing and her fact-driven style reminded me of something Marquez said in and interview — that there is no difference between storytelling and good journalism.

Me to J: “J, you know that with a pool in the backyard, you can swim every day, right?”]

You stared at me until the thought sunk in. You smiled first with your mouth, then your eyes became headlights. Almost exactly like this.

————–

Good morning!

I forgot to tell you that V let me know that Kehl did not write after all. I think her buyers have 3 kids and would need to expand the home right away.

The fourth hovering buyers also backed out as they believed it would sell for 1.3 and didn’t want to go that high. V told me that they would have removed the pool and the sellers love that pool – so any mention of removing it would have eliminated them! (I’m so glad that your letters referenced liking it.) In fact, during the escrow, the sellers and their kids will be returning to the house to enjoy the pool there since their current home doesn’t have one – and they really miss it!

So it was just B’s buyers and you. I did not hear from V how much B’s clients offered. Listing agents almost never tell the buyers or their Realtor how much competing bids were because no one wants the buyers to feel bad for whatever gap there was between the other offer(s) and the winning bid.

With multiple offers it really can swing either way. In the past I’ve had listings where I expected 4 offers and got 8, and other times the exact opposite – expected 4 and got 0!!! The zero experience is horrible and usually happens because all of the buyers are afraid of a multiple offer situation, ironically, creating none at all. We truly just never know.

V was heaping praise on you and your family for being so sweet. She and I are both excited that this will be a really nice transaction. Congrats again!

M

————–

Perfect. I am happy with the price we settled on. Thank you for all the research and detective work. The info you gathered was helpful for deciding what to offer. I never felt like there were any surprises. And even knowing the outcome now, I don’t think we would have made a different offer because of the “you never know” factor.

I am glad they liked that we liked the pool. We weren’t sure at first (and we’re still not sure if we’ll keep it forever). But for now it seems like a waste to rip up a perfectly good pool, especially while the kids still enjoy splashing about.

We actually decided that WE MUST TALK ABOUT THE POOL in the letter. Because after the open house on Sunday, I tried to be sneaky too. I hung around to chat with V and her husband to get as much info as I could about the sellers… tee hee 🙂 V told me their kids practically live in the pool. What I didn’t know was that they would have eliminated any offer that mentioned getting rid of the pool. Phew.

We hope you have a little more time to read and write at night now, now that you’re done helping us with house hunting 🙂

Me

————–

Thanks A. We three make a good team 🙂

V called me a little while ago to thank me for getting a jump on the next (behind the scenes) things that I needed to take care of. She told me that B Lister had offered to write a higher price when he learned that they were not getting it, but also he’d put in 5 days for a property condition contingency, and as you know, non-contingent is a lot stronger (if awfully uncomfortable for buyers). And she told me that today she had 2 more agents calling her to see about showing it – tooooo late!

I think you did well, too. It was really fortunate that there were just 2 offers. So often it’s a lot more than that!

Well done!

————–

We’re in Escrow now. It doesn’t feel real because all we did was sign some papers digitally. The biggest thing that’s stressing me out now is the “no appraisal contingency” in our offer. That means that if the house appraises for less than $1.3 mil then we’ll need to scramble to make up the difference in cash. But mama’s happy. If only you could see how happy she is. Abu too. A house to call home was something she always wanted to give her family.

Love,

Dad

Add your comment: